Content

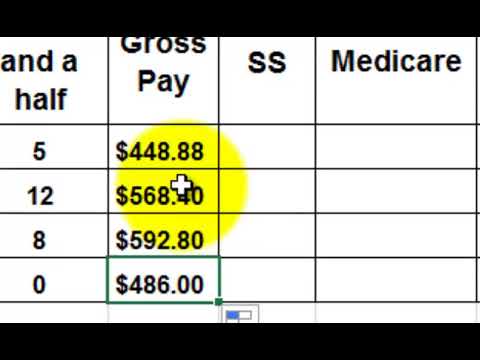

We’re going to go over a few more bookkeeping tips for beginners that are important for any entrepreneur to know. 2) Liabilities – When you take out a loan, you are incurring a liability. This means that you have received money that you will have to pay back to someone at some point. When it comes to AP, money is owed to a vendor and is paid at a later date. At the core of bookkeeping, there are debits and credits. When you get this principle down, the rest of bookkeeping becomes much easier.

As part of this process, you’ll need to choose a registered agent to accept legal documents on behalf of your business. The state will send you a certificate that you can use to https://quick-bookkeeping.net/ apply for licenses, a tax identification number and business bank accounts. She is also a digital marketing professional who has worked with leading brands in the tech industry.

Look to small business grants and local funding opportunities

Everything about you and the way you do business needs to let people know that you are a professional running a serious business. That means getting all the accoutrements such as professional business cards, a business phone, and a business email address, and treating people in a professional, courteous manner. Learn directly from someone else who has gone through the process to help you set up your new business for growth.

- Talk to fellow business owners in the area and consult free government-provided data on neighborhood and city demographics to help inform your decision.

- I love that you talked about all the important finances and expenses that should be tracked and organized.

- Taxes can be complex, and there are several different types of taxes you may be liable for, including income tax, self-employment tax, sales tax and property tax.

- Business interruption insurance pays for the loss of income if your business is forced to close temporarily due to a covered event such as a natural disaster.

- Make sure the organization’s productivity will increase over time using the appropriate LMS platform.

Additionally, you must acquire the proper local and state registration required to open your business. Gambian based solution provider in the area of training, investment and consultancy. Accounting software that automates the process of issuing invoices and follow-up notices could also aid in preventing the accumulation of unpaid invoices. Receipts are the key to financially sustaining your business. Ensure you keep every receipt for anything purchased or received in your enterprise.

Top 12 FREE Software For Small Businesses

Those who might just be entering the industry, however, should most definitely look at each of the said accounting tips for entrepreneurs carefully. Customer satisfaction and a positive client experience Accounting For Entrepreneurs, Tips To Follow When Starting Out are highly valued by the most successful businesses. The first stage is to produce the goods and services that consumers want. But focusing on your customers goes beyond just your offerings.

What should a startup entrepreneur know about accounting?

- Track Your Income & Expenses (Income Statement)

- Track Your Assets, Liabilities, and Equity (Balance Sheet)

- Have Separate Bank/Credit Card Accounts under the Company Name.

- Save for Taxes.

- Think about Sales Taxes, File if Necessary.

- File Your Income Taxes.

Starting a business is one of the most exciting and rewarding experiences you can have. There are several ways to approach creating a business, with many important considerations. To help take the guesswork out of the process and improve your chances of success, follow our comprehensive guide on how to start a business. We’ll walk you through each step of the process, from defining your business idea to registering, launching and growing your business. We accept payments via credit card, wire transfer, Western Union, and bank loan.

What are the four basics for starting a business?

You can make a standard informational website or an e-commerce site where you sell products online. If you sell products or services offline, include a page on your site where customers can find your locations and hours. Other pages to add include an “About Us” page, product or service pages, frequently asked questions , a blog and contact information.

Check with local chambers of commerce or other small business groups in your area to see what help is available – there tend to be more resources out there than you might think! Have a professional help you to understand how the finances will work, whichever route you go. Here’s how to choose a business checking account—and why separate business accounts are essential. When you open a business bank account, you’ll need to provide your business name and your business tax identification number . This business bank account can be used for your business transactions, such as paying suppliers or invoicing customers. Most times, a bank will require a separate business bank account to issue a business loan or line of credit.

Services

Without a financial captain steering your ship, you’re likely to run aground. You’ll sleep much better at night knowing that you have someone you can trust at the helm, especially in your accounting department. Business tools can help make your life easier and make your business run more smoothly.

How do you manage accounting for a new business?

Accounting for small businesses is done by keeping a complete record of all the income and expenses and accurately extracting financial information from business transactions. This is a necessary chore that helps small business owners track and manage their money effectively – especially during the early stages.